Table of Contents

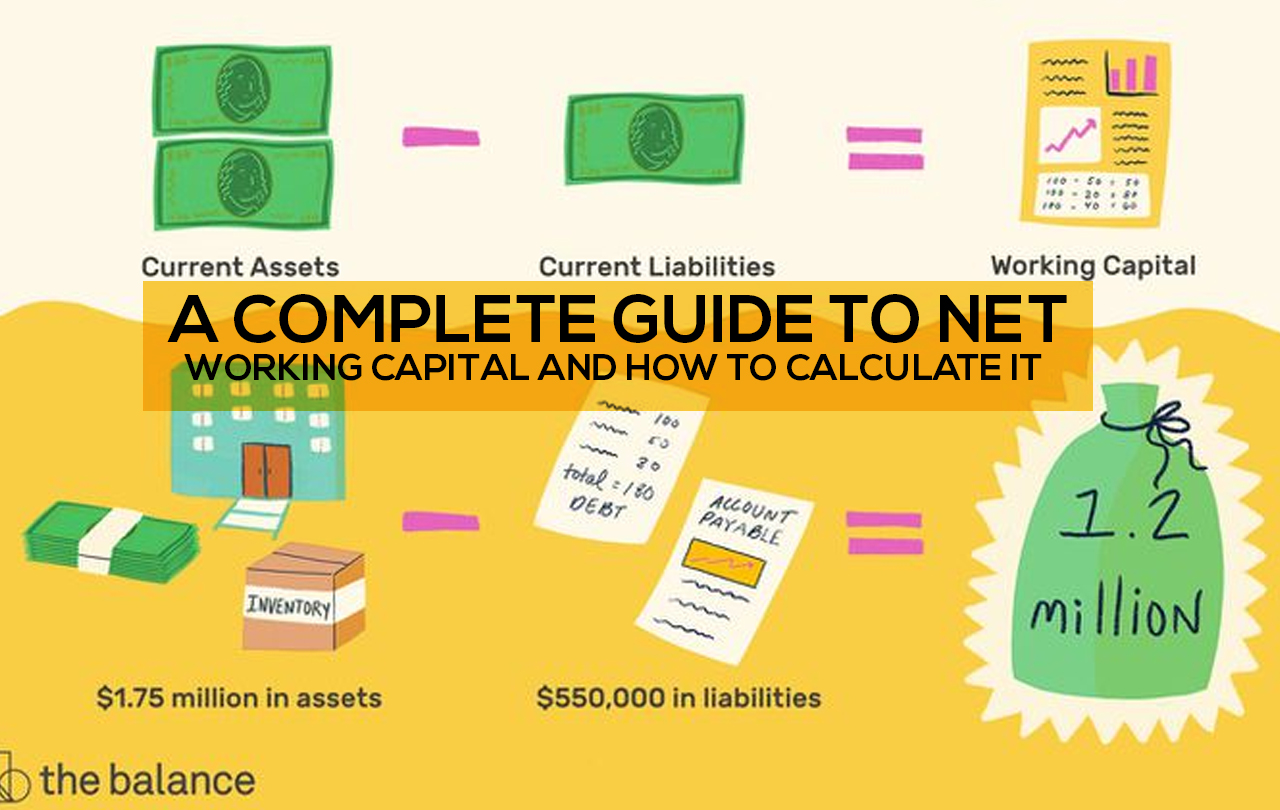

What is networking capital?

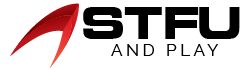

Networking capital is also known as simply working capital. It indicates a company’s liquidity position. That is, the company’s ability to meet its short term financing needs. Networking capital is the difference between a company’s total current assets and total current liabilities. A positive net working capital indicates that the company has enough funds to meet its short term obligations. On the other hand, a negative net working capital shows the company has more short term liabilities than the number of funds to pay for them.

Current Assets: –

Current assets are short term assets that are held for a maximum of one year. These are easily convertible into cash hence are known as good indicators of a company’s liquidity position. Current assets include the following:-

Inventories: –Stocks of goods that are with the company to be sold to the market are known as inventories. Inventories include raw materials, semi-finished, and completed goods. These are easily convertible into cash as they must be sold within a year hence termed as current assets.

-

Debtors: –

Also known as accounts receivables, debtors are those who have received your good but have not made the payment yet. These accounts are expected to make payment within the time of one year’s reason why they are classified as current assets. Ideally accounts receivables must be recovered within 90 days with a successful collection rate of 90%.

-

Cash and cash equivalents: –

Cash in the company, as well as cash equivalents, are also current assets. Cash refers to all the currency notes, checks received, coins, bills, and petty cash. Cash equivalents include money in the bank account, treasury bills, commercial paper, money market funds, and short-term government bonds.

-

Prepaid expenses: –

Prepaid expenses are also considered as current assets given that they become due in a matter if a few months since the time of being recorded in the balance sheet. For instance, if the business has paid out the rent for the whole year at the start of January, the amount will be recorded as prepaid rent in the current assets column. Every month this figure will reduce by the amount equal to the monthly rental expense.

Since networking capital is defined as the difference between total current assets and total current liabilities, it is important to know all the possible components of current assets. These were some of the common types of current assets a typical business might have.

Current Liabilities: –

Current liabilities refer to the financial obligations a business must meet within a time period of one year. Here are some examples of current liabilities.

-

Accounts payable: –

The amount of money the business owes to suppliers and creditors is classified as current liabilities. These accounts are created for the purchase of goods on credit for continuing the operational activities of the business.

-

Short-term loans: –

Short-term loans that are obtained for a year to fill in the cash flow gap or launch a new product are a kind of current liability.

-

Accruals: –

The company’s expenses that have been incurred but not yet paid for are termed as a current liability. Accrued salaries, utilities, or interest expenses that have not been paid yet are accrued expenses.

-

Current portions of long-term liabilities: –

That part of long-term loans that are due within a year is referred to as current liabilities.

Adding up all the current liabilities gives a value of total current liabilities for a particular business.

Networking capital formula: –

The networking capital formula is very simple. This is how to calculate net working capital: –

Networking capital=Total Current Assets-Total Current Liabilities

A business has a total of $4500 current assets and $3000 current liabilities. This is how you can calculate net working capital: –

Networking capital=$4500-$3000=$1500

Importance of Networking capital: –

Networking capital is defined as the lifeblood of any organization. It provides the funds that are required for the smooth and effective running of any business. It indicates the operational efficiency of a company. A zero net working capital indicates that the company has funded just enough to cover its current liabilities. This is not a favorable prospect as the company might lack funds to ensure future growth and success. A negative net working capital is even worse indicating quite a poor liquidity position. If the business fails to increase its current assets it would likely become bankrupt shortly. On the other hand, too much positive working capital is also not a good indicator. It means the company’s funds that could be invested to expand the business are lying idle. Hence an efficient level of net working capital must be maintained to ensure business profitability and growth.

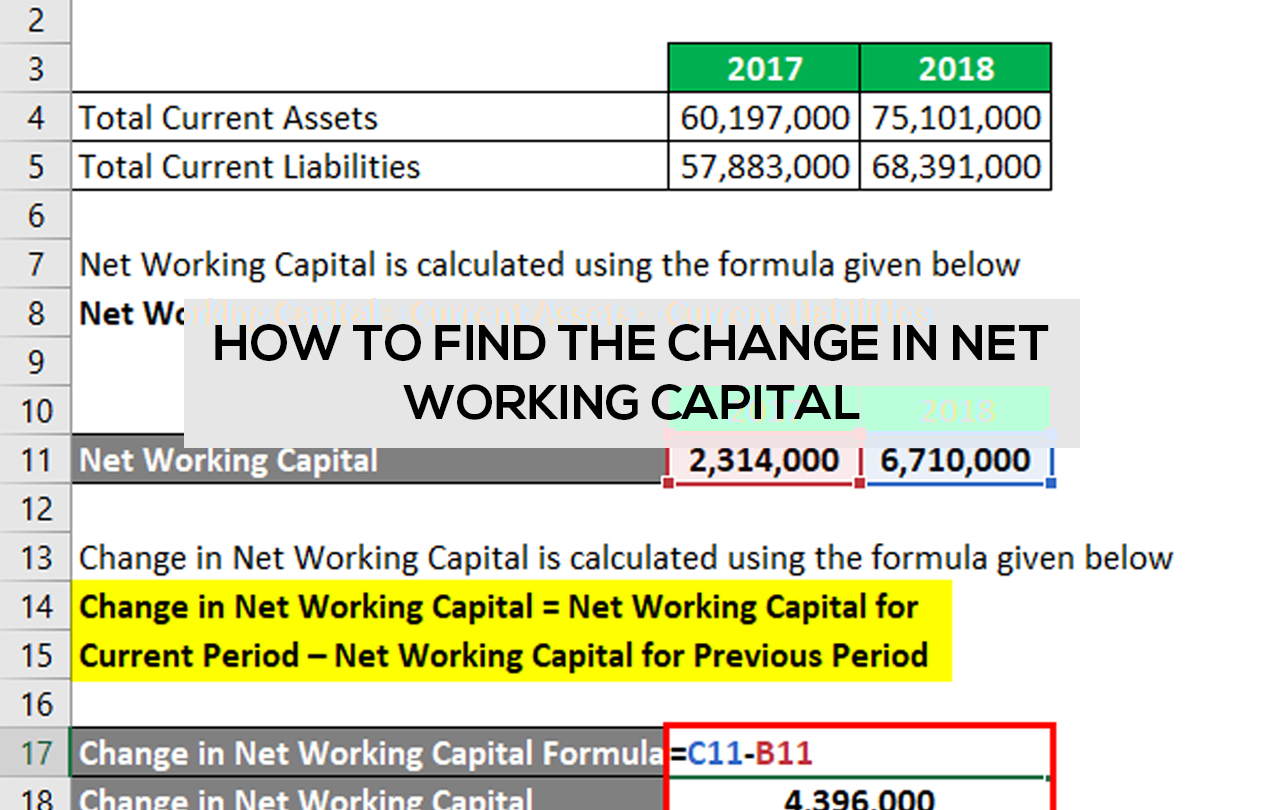

How to find the change in Networking capital: –

Change in net working capital is very important to analyze a business’s financial performance over the years. It is used to examine whether the company’s currents assets are increasing or decreasing as compared to current liabilities from one fiscal period to another. Change in net working capital is calculated by the following formula:- Current networking capital-previous net working capital An unfavorable change in networking capital does not necessarily mean that the business is doing poorly. It might be because the business is expanding which might temporarily harm net working capital but have promising returns in the future. Another very important factor when analyzing financial values is to consider the industry average.

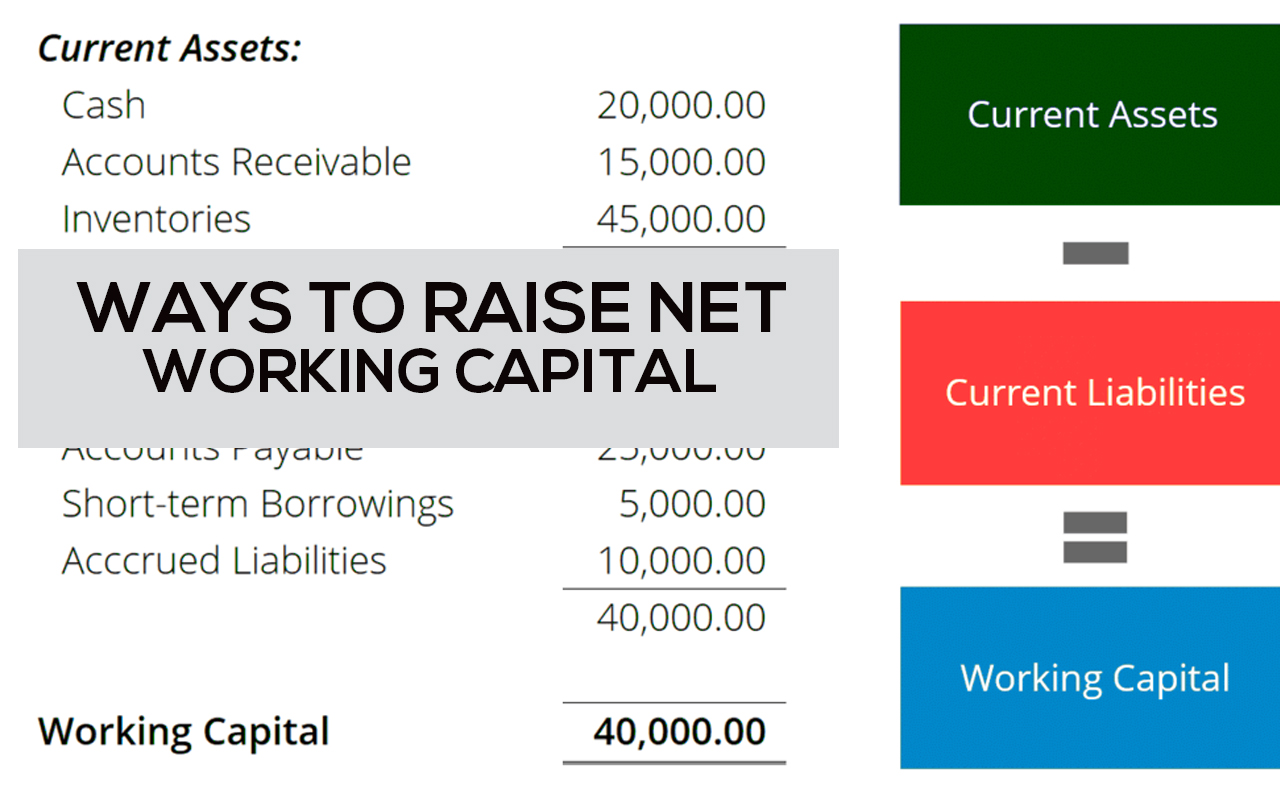

Ways to raise Net working capital: –

A clear understanding of what is networking capital will help you discover ways to increase its value. Networking capital can be increased by selling off long-term assets that are not needed by the business. These include old office equipment or any other facility that is no longer useful. Finding ways to improve inventory turnover can also help increase current assets.

FAQs: –

[wps_faq style=”classic” question=”Q: What is considered a good working capital ratio?”]A: A ratio of 1.5-2 is considered as a healthy working capital ratio.[/wps_faq][wps_faq style=”classic” question=”Q: What factors impact the working capital?”]A: Here are some factors that impact working capital: – • Business type • Operating cycle duration • Credit is given and availed • Seasonal factors • Production cycle [/wps_faq][wps_faq style=”classic” question=”Q: What is the working capital cycle?”]A: It refers to the time it takes for the current assets and current liabilities to be converted into cash.[/wps_faq][wps_faq style=”classic” question=”Q: What are the different types of working capital?”]A: Here are some of the different types of working capital: – • Networking capital • Gross working capital • Variable working capital • Seasonal variable working capital • Permanent working capital [/wps_faq]